Private Equity Growth Capital Council Releases Annual Pension Study, Powered by Bison

Massachusetts Pension Reserves Investment Trust Fund Tops Yearly Study with 17.93 Percent Annualized 10-Year Private Equity Return

WASHINGTON – Today the Private Equity Growth Capital Council…

Massachusetts Pension Reserves Investment Trust Fund Tops Yearly Study with 17.93 Percent Annualized 10-Year Private Equity Return

WASHINGTON – Today the Private Equity Growth Capital Council (PEGCC) released its annual ranking of large public pension funds, revealing which pensions generated the highest rate of return from their private equity portfolios and which ones invested the most in private equity.

The report found that the Massachusetts Pension Reserves Investment Trust Fund rose to first place based on private equity returns, up from second place last year. Read this year’s full report here.

“This study shows that private equity is the best performing asset class for public pension funds over the long term,” said Bronwyn Bailey, PEGCC Vice President of Research. “Private equity not only strengthens the performance of pensions’ investment portfolios, it is a critical component to the retirement security of millions of Americans.”

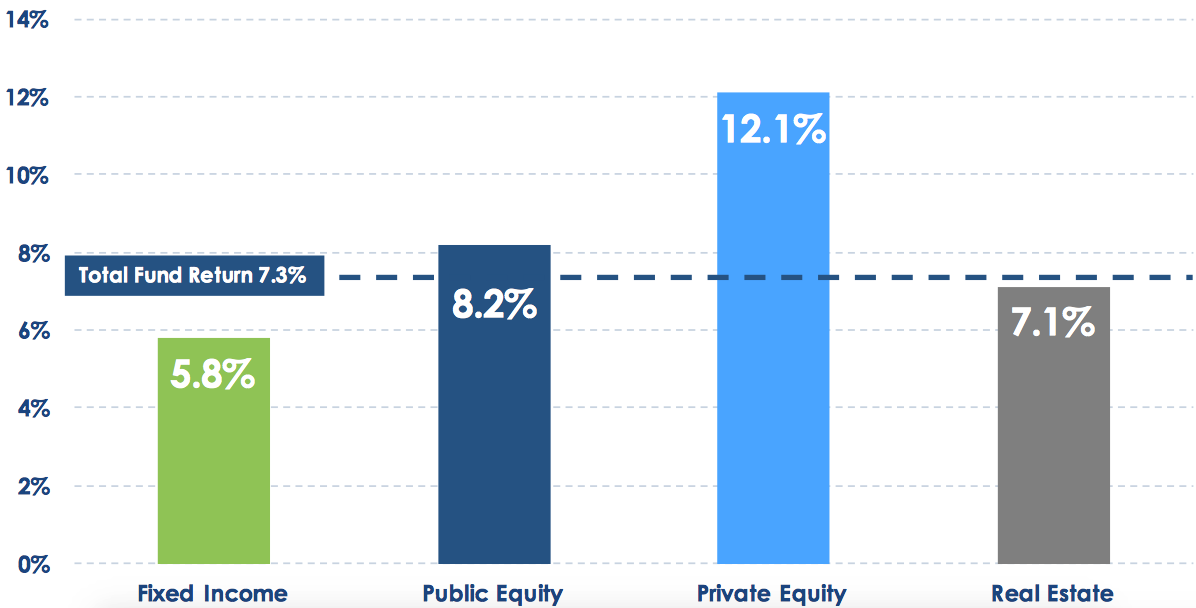

The report found that private equity delivered a 12.1 percent annualized return to the median public pension over the last 10 years, higher than any other asset class.

The top five pension funds by annualized 10-year private equity returns:

- Massachusetts Pension Reserves Investment Trust Fund: 17.93 percent.

- Teacher Retirement System of Texas: 17.80 percent.

- Minnesota State Board of Investment: 16.20 percent.

- Houston Firefighters’ Relief and Retirement Fund: 16.00 percent.

- Iowa Public Employees’ Retirement System: 15.70 percent.

This is the second year that the PEGCC has partnered with Bison for its annual pension study. Bison is an industry-leading financial technology company that benchmarks and analyzes private fund data.

“The study on private equity holdings of public pensions highlights the opportunity for investors to use private equity to drive their portfolios’ investment performance,” said Michael Roth, Research Manager at Bison. “Our research also illustrates the value of building a comprehensive dataset that can facilitate benchmarking among managers and across asset classes.”

View our infographic, and our interactive map with more information on how private equity strengthens pension funds, and read the full report here.

About the Annual Pension Study

This study is conducted by the PEGCC using data collected by Bison to examine the private equity investments of over 155 U.S. public pension funds. The information was collected either through direct communication with pension funds or from publicly available comprehensive annual financial reports. The reporting date for data used in this study ranges from March 31, 2014 to December 31, 2014, with most dates as of June 30, 2014. Out of the 155 pension funds sampled, three reported only gross returns. The analysis of pension fund investment returns is based on available 10-year return data as of June 30, 2014, for each asset class.

About the Private Equity Growth Capital Council

The Private Equity Growth Capital Council (PEGCC) is an advocacy, communications, member services, research organization and resource center established to develop, analyze and distribute information about the private equity and growth capital investment industry and its contributions to the national and global economy. The members of the PEGCC consist of the world’s leading private equity and growth capital firms united by their commitment to growing and strengthening the businesses in which they invest. More information about the PEGCC can be found at www.pegcc.org.

About Bison

Bison is a leading performance benchmarking provider for the private equity and venture capital industry. Their platform delivers innovative and intuitive solutions for analyzing private fund data, monitoring fund performance and unlocking value through comprehensive benchmarking. Their customers benefit from their proprietary and transparent private market dataset as well as live feeds of public market data. More information can be found at www.bison.co.