Research

The AIC produces reports that inform readers about private equity investments. We publish quarterly and annual reports that provide current information about investment trends, fund performance, sector-specific investment, and private equity returns to pension funds. The AIC also monitors research by academics and other analysts and have curated a collection of important articles.

Sector Research

Showcases how private equity is playing an increasingly important role in the growth and continued strength of the life sciences industry.

As global leaders work to address the climate crisis, today’s private equity firms are investing billions in capital into fast-growing clean energy sectors such as solar, carbon capture, and battery storage.

Examining private equity’s role in financing American innovation – from scaling promising startups to helping large companies stay competitive in a fast-changing world.

Regular Reports

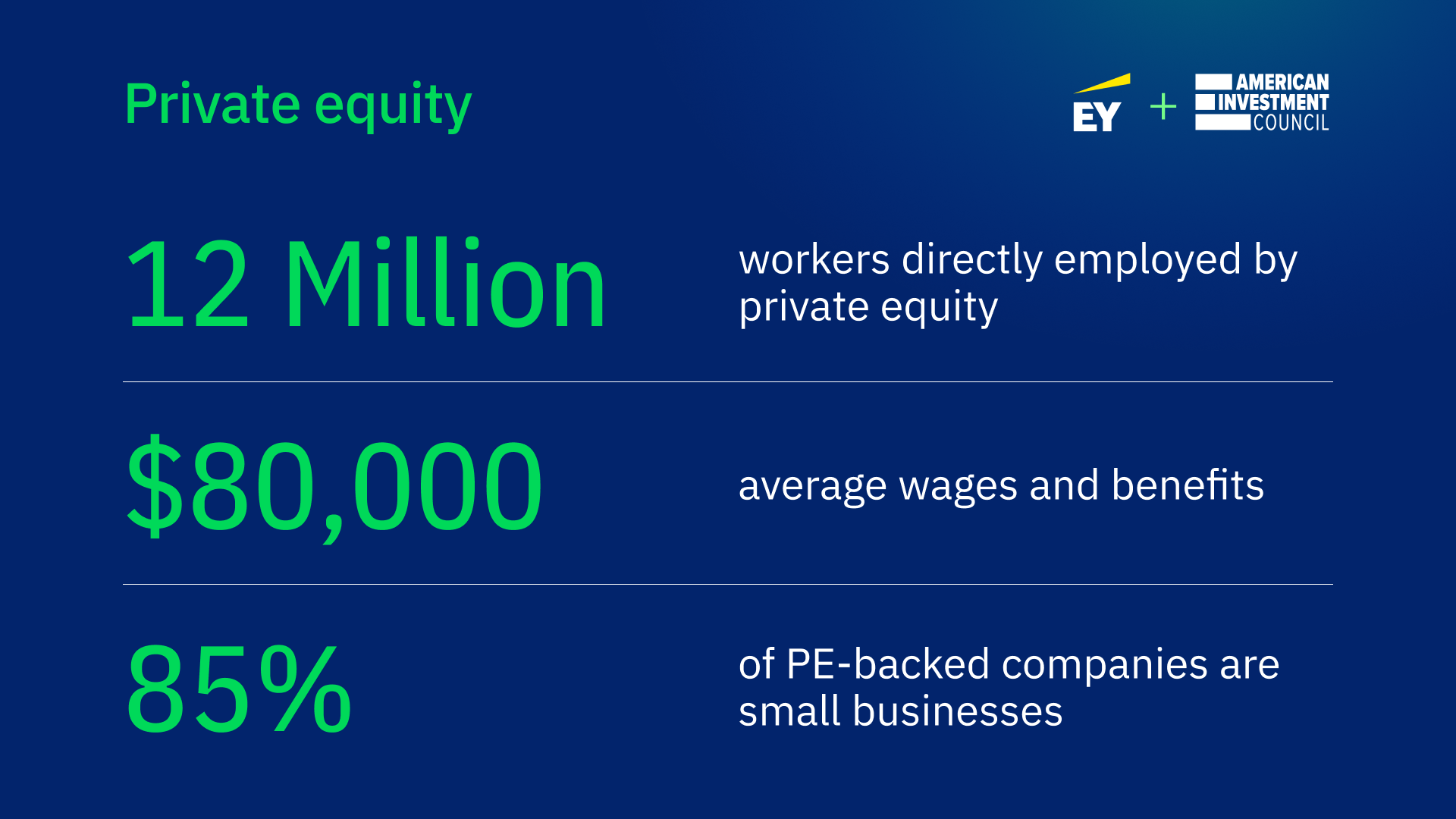

Private equity directly employed 12 million workers in the United States in 2022, up from 11.7 million jobs in 2020, and generated $1.7 trillion of gross domestic product (GDP), or approximately 6.5% of total GDP. Workers at private equity-backed businesses earned approximately $80,000 in annual wages and benefits, up from $73,000 in 2020.

Using publicly available financial information from U.S. pension funds, this annual report compares the performance of private equity to other asset classes (e.g., public equity, fixed income, and real estate) and ranks the Top 10 public pensions by their private equity returns.

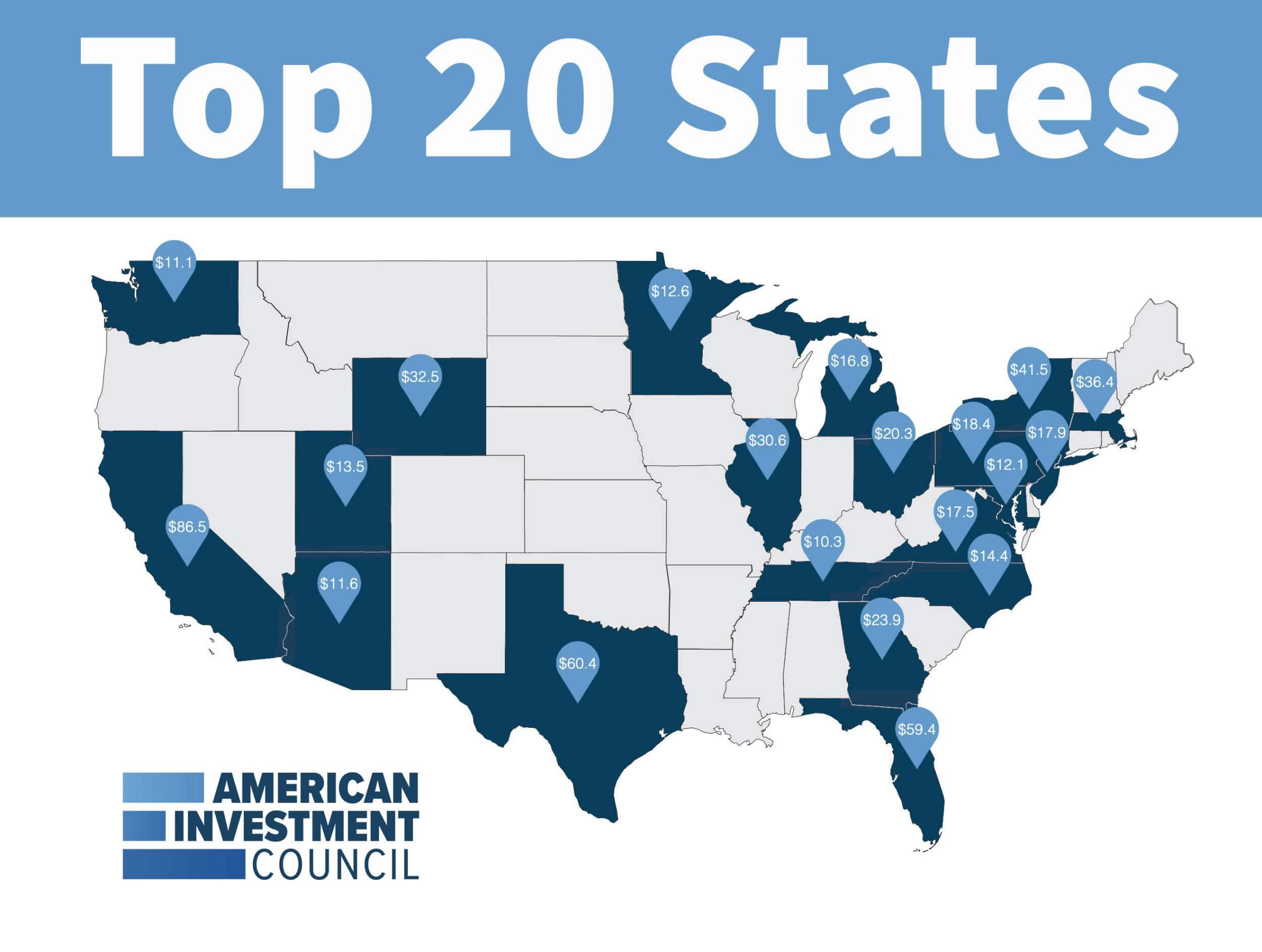

Where do private equity fund managers invest? The answer: in almost every state and U.S. Congressional district. This annual report ranks the top 20 states and districts by private equity investment.

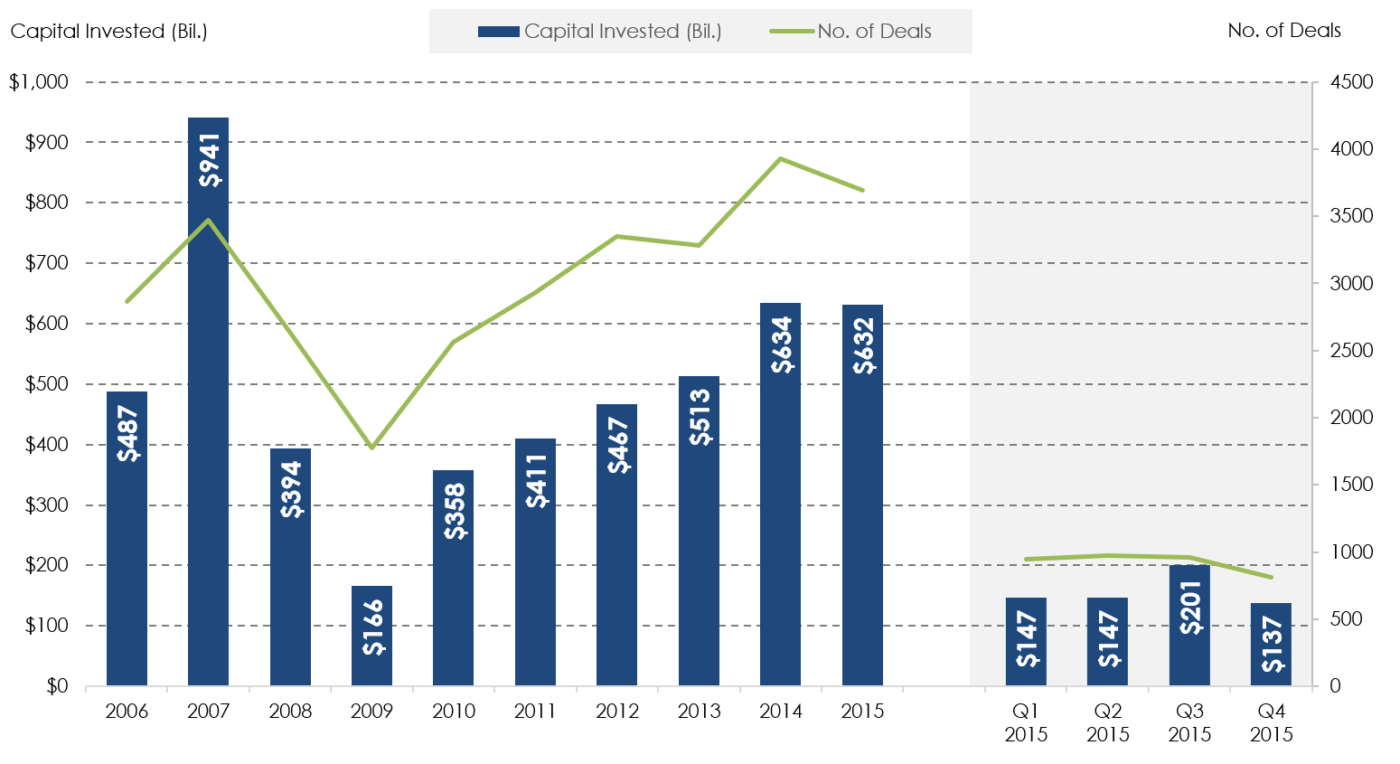

Provides an overview of the fundamentals in the private equity each quarter, including investment volume, equity contributions, fundraising, dry powder levels, and exits.

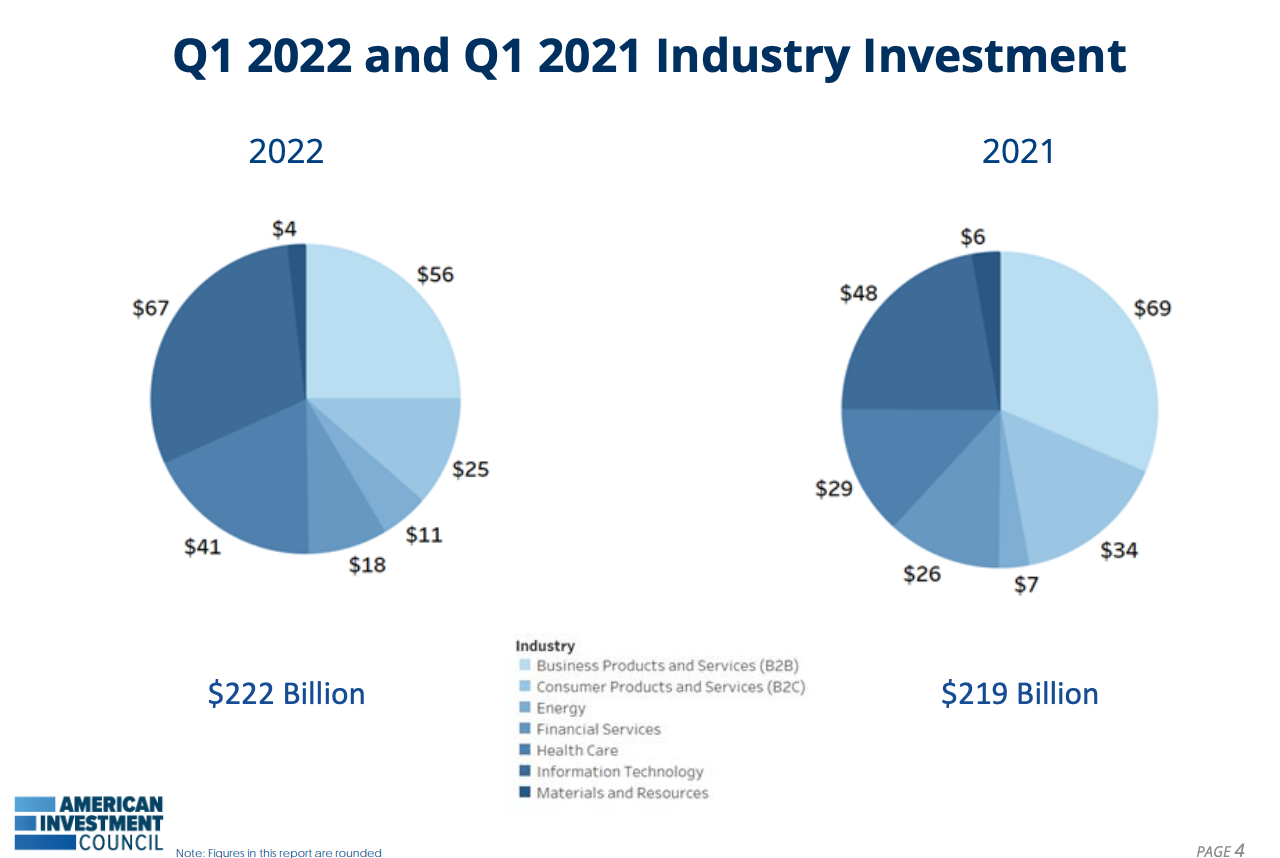

Analyzes changes in private equity investment each quarter for industrial sectors including business products & services, consumer products & services, information technology, financial services, healthcare, materials & resources, and energy.

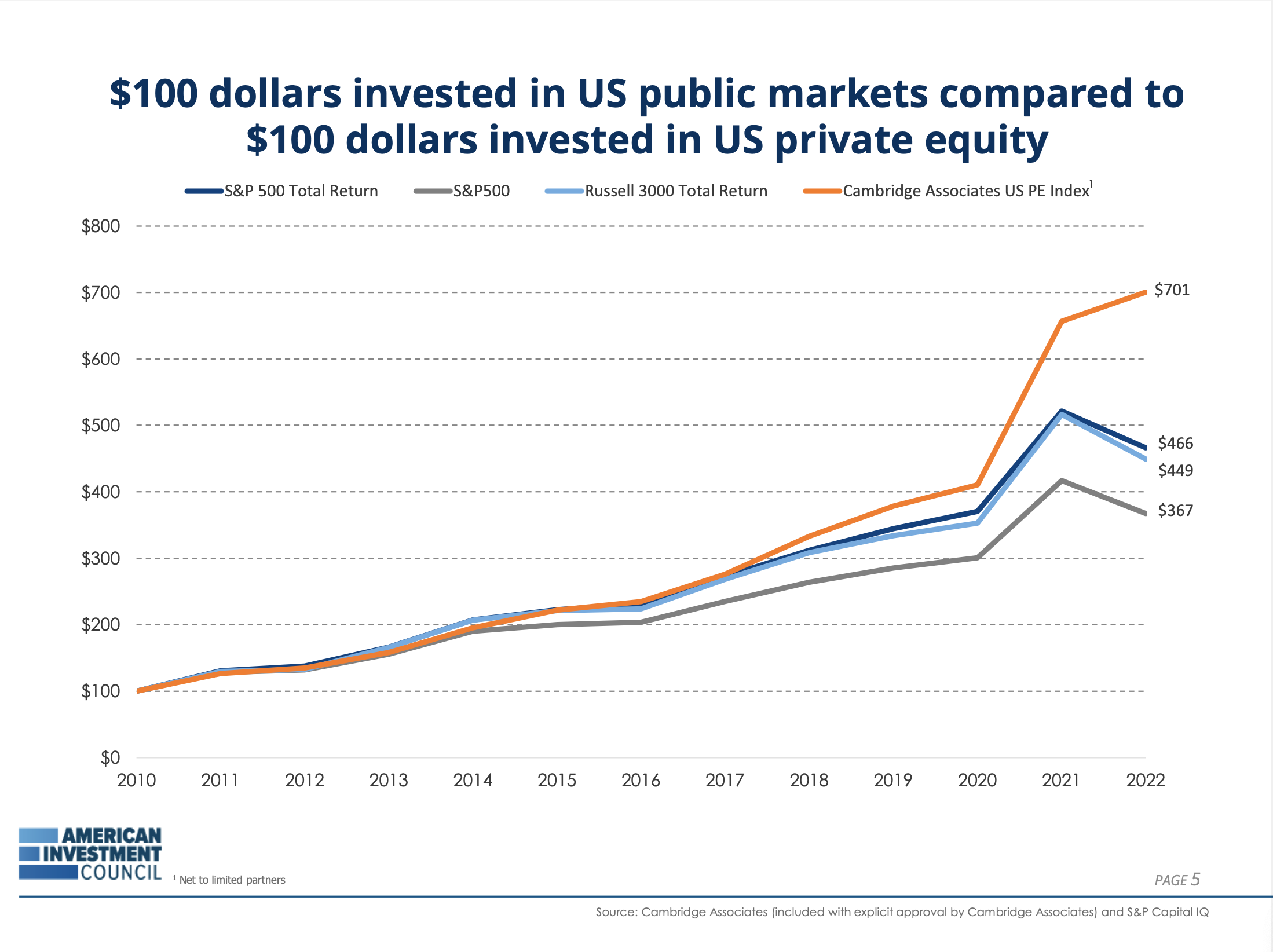

Evaluates private equity fund returns each quarter relative to public market indexes, based on publicly available benchmarks and public pension fund returns over multiple time horizons.

Find academic studies of private equity on the on Other Industry Analyses page.